Car Loan After Bankruptcy in Ontario: A Practical Guide to Getting Approved (and Rebuilding Credit)

- Rick Paletta

- Jan 16

- 4 min read

If you’re searching for a car loan after bankruptcy in Ontario, approvals are possible—especially when you bring the right documents, choose a sensible vehicle, and build a payment plan you can comfortably maintain.

Bankruptcy is a hard chapter—but it can also be a turning point. For many Ontario drivers, it’s the moment they stop juggling old debt and start rebuilding with clearer boundaries and better habits.

If you need a car loan after bankruptcy, the goal isn’t just “getting approved.” It’s getting approved on terms that help you move forward: a reliable vehicle, a payment you can live with, and a realistic plan to improve your credit over time.

If you want to start with the simplest next step, you can do it online here: Get Pre-Approved at Unique Chrysler.

Key Takeaways

You may qualify for an auto loan during bankruptcy or after discharge—it depends on your lender, income stability, and your insolvency terms.

Lenders look hardest at your ability to repay today: verified income, stability, and a payment that fits your budget.

Vehicle choice matters: the right price point and ownership costs can improve approval odds.

Bankruptcy may remain on your credit report for years, so rebuilding is about consistent on-time payments and not overextending.Helpful references: FCAC – How long information stays on your credit report and Equifax Canada education.

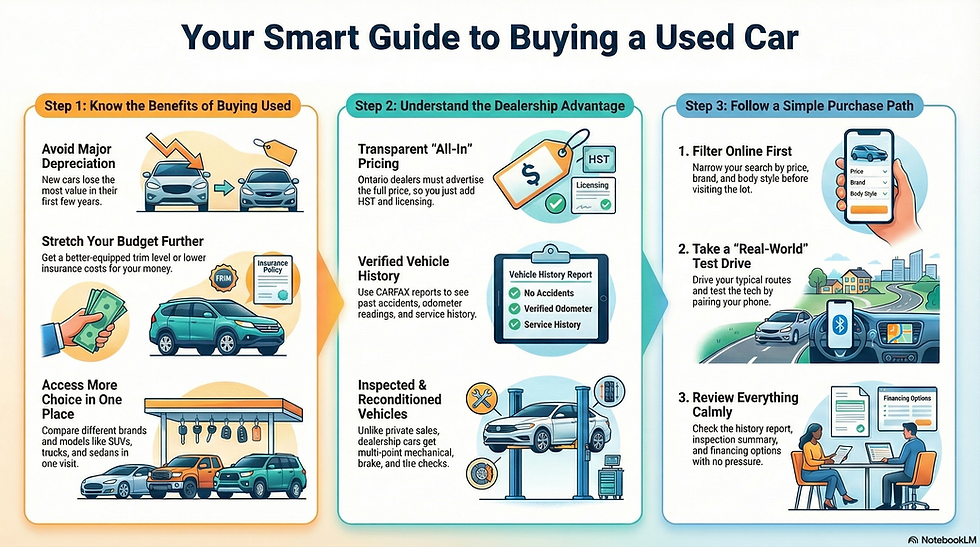

In Ontario, advertised vehicle pricing must follow all-in price rules (HST and licensing are exceptions).Reference: OMVIC – All-in Price Advertising.

Can You Get a Car Loan After Bankruptcy in Ontario?

Yes—many Ontarians do. Approvals happen at different stages, including:

While bankruptcy is active (case-by-case)

Right after discharge

After 6–12 months of rebuilding with stronger payment history

After a consumer proposal (often similar underwriting, depending on lender)

What changes most across those stages isn’t your “worthiness”—it’s what a lender needs to see to feel confident you can repay the loan now.

Bankruptcy vs Consumer Proposal (Why It Matters for Auto Financing)

Both bankruptcy and consumer proposals are part of Canada’s insolvency system overseen federally. Reference: Office of the Superintendent of Bankruptcy (OSB).

From a car-loan standpoint:

Bankruptcy: some lenders prefer you be discharged; if you’re undischarged, you may need trustee confirmation depending on your situation.

Consumer proposal: many lenders will consider you if you’ve made consistent payments and your budget supports the new obligation.

What Lenders Look At for a Car Loan After Bankruptcy

A bankruptcy tells lenders something about the past. Approvals are built on your present-day stability.

1) Verified income (and how stable it is)

Expect to show proof of income (pay stubs, statements, or documentation for self-employment).

2) Housing stability

Time at address and monthly housing cost help lenders assess affordability.

3) Your “total budget,” not just the payment

A smart approval includes:

Insurance

Fuel

Maintenance/tires

Winter driving costs

If you want a quick reality check on monthly numbers before you shop: Use the Payment Calculator.

4) Vehicle choice (this matters more than most people think)

When rebuilding, it often helps to focus on:

A reasonable purchase price

Predictable ownership costs

A structure that doesn’t push the loan amount too high relative to the vehicle’s value

You can browse options anytime here: Used Vehicles in Burlington.

5) Down payment and/or trade-in equity

A down payment or trade can lower the amount financed and improve affordability.

If you have a vehicle to trade, start here: Trade-In Your Vehicle.

Timing: When Are You Most Likely to Get Approved?

There’s no single perfect month, but generally:

During bankruptcy: possible, but stricter and may require trustee sign-off depending on your terms

After discharge: common, especially with stable income/housing

After 6–12 months of consistent payments: often better options as your file strengthens

Bankruptcy timelines on credit files can vary; see:FCAC – How long information stays on your credit report and Equifax Canada education.

Document Checklist: What to Bring

To reduce delays, bring:

Government photo ID

Proof of income

Proof of address

Insurance info (if available)

Bankruptcy/proposal documents (if applicable)

Notes on your monthly budget

Budget Guardrails: How to Avoid a Payment That Sets You Back

Keep the full cost of ownership in view (not just payment).

Choose a term that fits your budget without stretching.

Don’t shop to “max approval”—shop to a payment that protects your rebuild.

Financing note (Ontario): Any payment examples or financing discussions are on approved credit (O.A.C.) and depend on lender approval, term, down payment, vehicle, and your individual credit profile.

Rebuilding Credit with an Auto Loan: What Actually Helps

A car loan can help rebuild credit if it’s managed well:

Pay on time, every time

Avoid stacking multiple new credit applications at once

Check your credit report for accuracy

Useful overview: FCAC – Credit reports and scores

Ontario Transparency: Understanding “All-In” Vehicle Pricing

Ontario consumers have protections around advertised pricing. OMVIC explains all-in price advertising expectations here:OMVIC – All-in Price Advertising

Local Help in Burlington and GTA West

If you’re in Burlington, Hamilton, Oakville, Milton, or across Halton Region, you can start online and keep the process simple:

Apply online: Get Pre-Approved

If you’re rebuilding credit: Bad Credit Car Financing in Burlington

Get to us quickly: Get Directions to Unique Chrysler or Directions on Google Maps

FAQ: Car Loans After Bankruptcy (Ontario)

Can I get a car loan while still bankrupt?

Sometimes, yes—case-by-case. Stability and affordability matter most, and your insolvency terms may require trustee coordination.

How long does bankruptcy stay on my credit report in Canada?

Timelines vary. Start with: FCAC – How long information stays on your credit report

Will a down payment help me get approved?

Often, yes. It reduces the amount financed and can strengthen affordability.

Should I finance new or used after bankruptcy?

It depends on your budget and overall ownership costs. Many rebuilding buyers prefer used to keep the loan amount manageable. You can browse here: Used Vehicles in Burlington

--------------------------------------------------------------------------------------------------------------------------

With over four decades in the automotive industry, Dealer Principal Rick Paletta is a trusted name across the Hamilton–Burlington region. Born and raised locally, Rick is respected for his integrity, work ethic, and people-first leadership—and he still loves this business because it’s about helping neighbours, building relationships, and matching people with vehicles they’re excited to drive. His commitment to the community shows up in consistent giving, including long-running support of McMaster Children’s Hospital through Car Nation Cares.

Comments